Not Everything Is Worth Saving

Many patent attorneys are hoarders. They'd pay any fee to keep a case alive until the bitter end. Ask them why and you'll hear the same thing: "Just in case!" or "But I've spent so much money on it!" Are these strategies or habits?

Even if some attorneys wanted to prune more, the costs are invisible. It’s hard to kill something when you don’t know what keeping it alive costs, or what else that money could buy.

The mistake isn’t not pruning, it’s not comparing.

Contribute $50/week into your kid's Roth IRA at 5 years old. When they retire, they'll get $2M. Small, consistent actions compound over time.

Same idea with patent renewals. Drip, drip, drip… until you realize you’ve spent 7 figures keeping weak patents alive.

Here's what good pruning looks like: You drop 10 zombie cases and buy a single patent that actually covers a competitor. You abandon a dead-end tech family and redirect to continuations in areas where people are building real products today.

But to make those trades, you need visibility:

- What are we spending to keep this alive?

- Is it in an over-filed area?

- What else could we be buying instead?

- Where are the gaps in our coverage?

One thing we do know is that patents with 8-12 years of life left have the highest probability of being valuable in licensing (Thanks Richardson Oliver Group). It may be wise to keep patents alive until at least then assuming the tech still matters.

Anything older, attorneys should consider whether money is better spent on new filings or buying what they need.

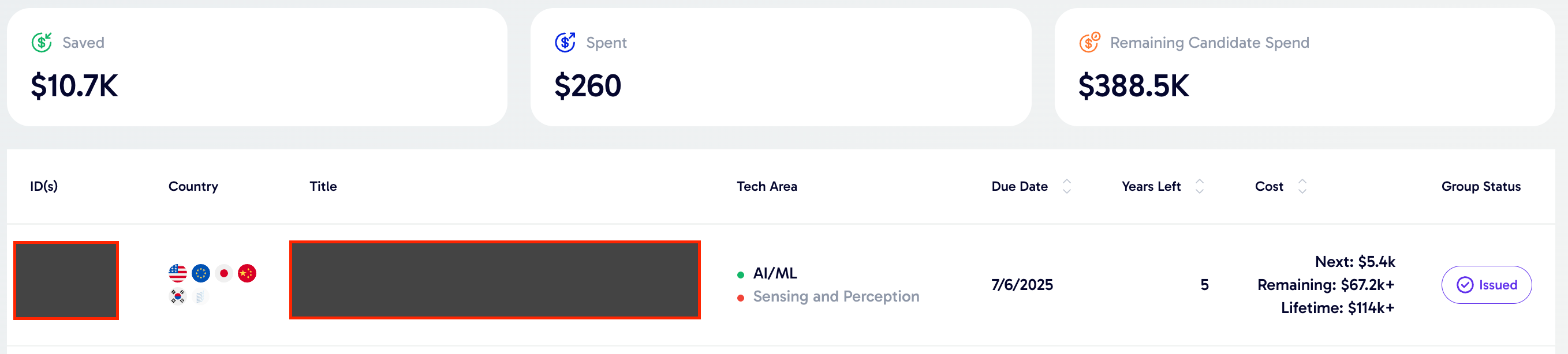

This is where ArcPrime comes in. It shows exactly what you’re paying, what you’re saving, and where you’re overexposed. Red means over-filed. You can see how much it is to keep a family alive for the remainder of its lifetime, total lifetime cost, and expensive / hard-to-grant outlier cases.

Letting just 10–15 families with five years left lapse can save $670k-1M+ (see screenshot). This can be enough to buy a litigation-ready patent with a claim chart. Not a bad trade.

The best patent portfolios aren't the biggest. They're the most surgical.